Insurance Fraud Program Educate Citizens About the Real Cost of Insurance Fraud

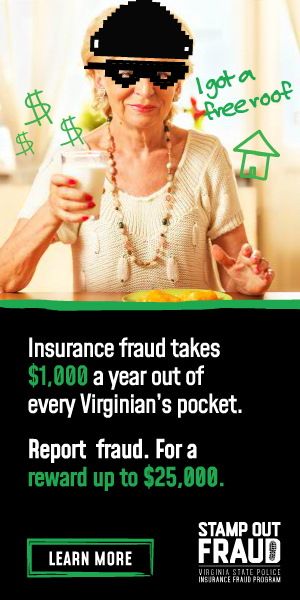

The Virginia State Police Insurance Fraud Program has launched a new campaign designed to educate the public about the real cost of insurance fraud to all Virginians. The campaign includes radio and a variety of digital media including social, banner ads, YouTube, and native ads.

First Sergeant Peter W. Lazear, Virginia State Police Insurance Fraud Program Coordinator, explains the challenge of combatting insurance fraud. “Insurance fraud is complex—it includes property, casualty, and workers’ compensation fraud—and consumers see it as a victimless crime.”

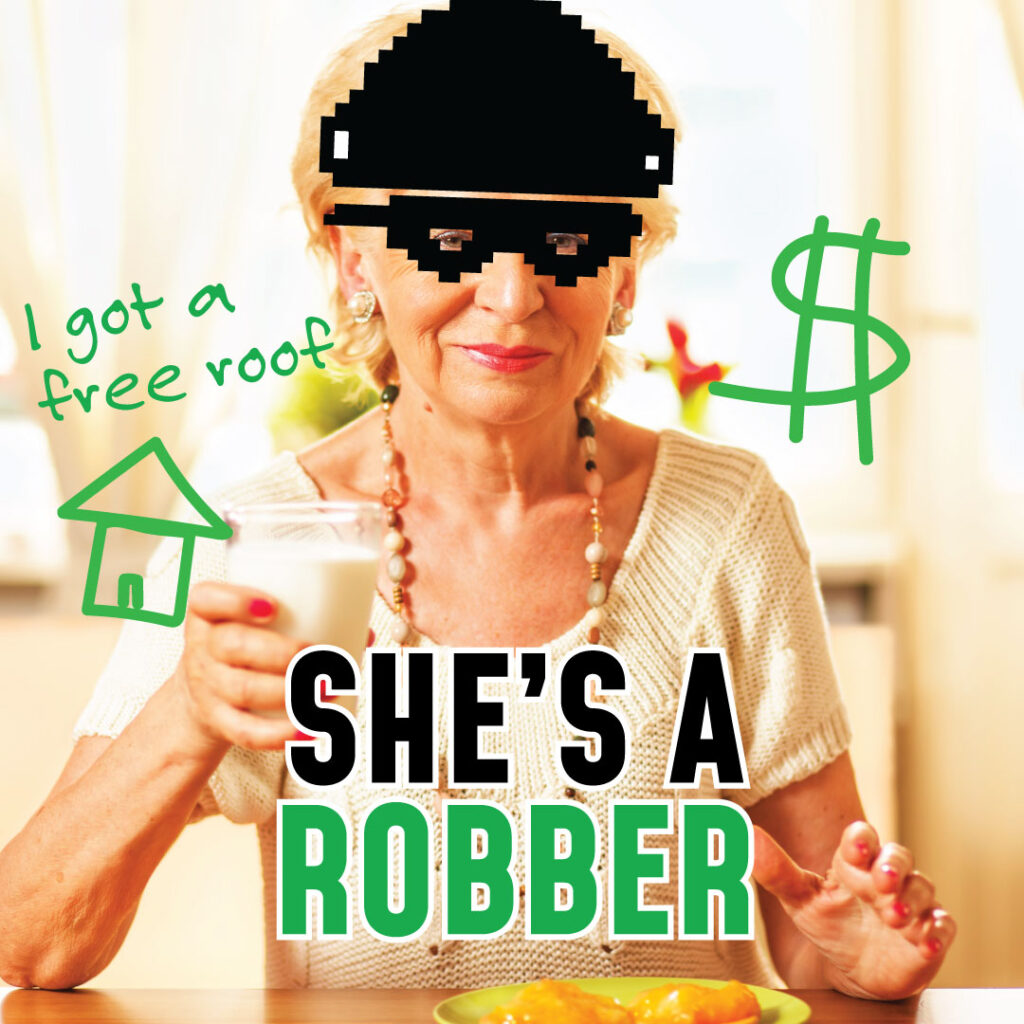

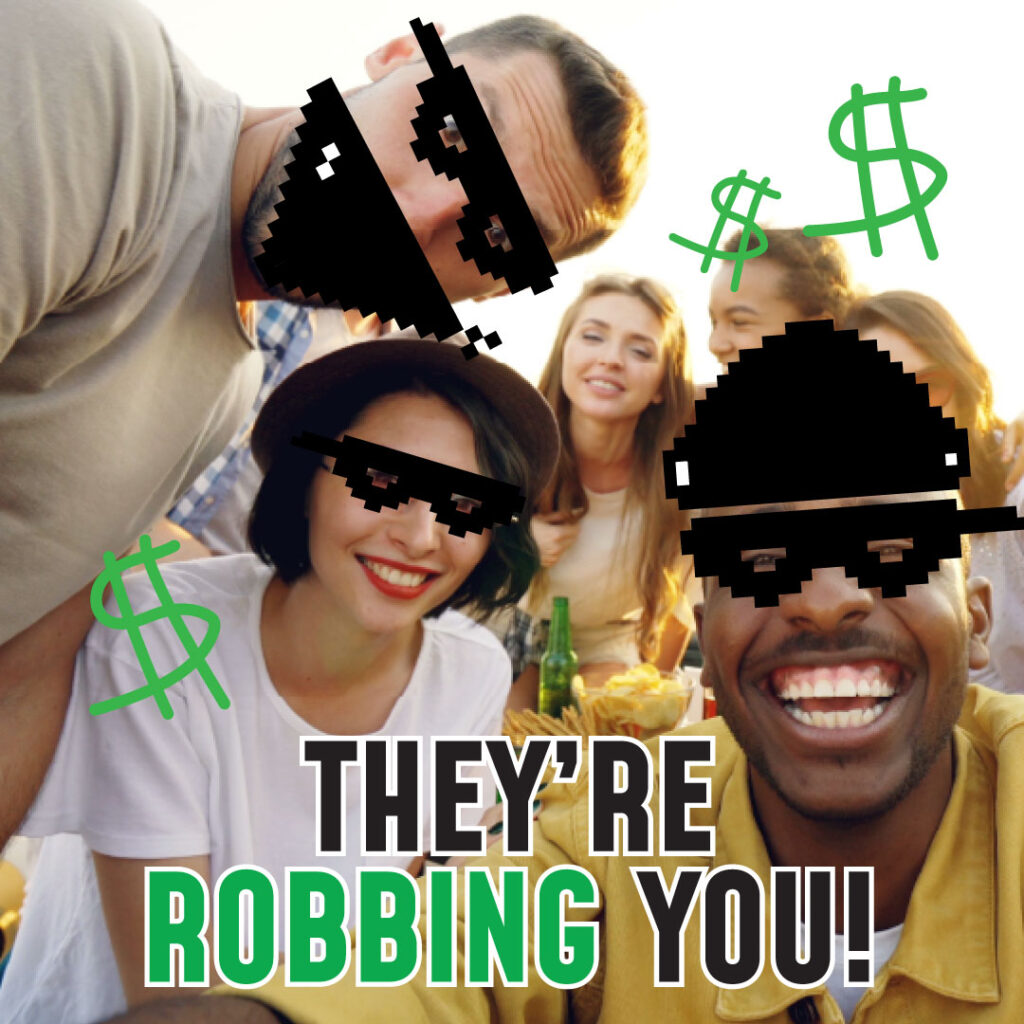

The campaign conveys two messages. First, everyday people—like your grandmother or the nice guy who lives next door—can commit insurance fraud. Second, we all pay for it. In fact, insurance fraud cost the average person $1,000 a year in added premiums. The use is humor makes the ads fun and approachable.

The Virginia State Police, working in collaboration with other law enforcement agencies, is committed to fighting insurance fraud. “We are even enlisting the public in our efforts,” says F/Sgt. Lazear. “If you suspect someone of insurance fraud, you can submit a confidential tip and receive a reward of up to $25,000 for information leading to an arrest.”

Campaign creative examples: